april 2016 service tax rate

The calculation of the amount that can be levied is done as a percentage of the charges paid or received for the receipt or provision of services. I hope this article has updated you about service tax changes from 1st April 2016.

Tax Principles Relx Information Based Analytics And Decision Tools

40 on annual earnings from 32001 to 150000.

. However this rate will be increased from 1st June 2016 by 050 on account of Krishi Kalyan Cess. With Krishi Kalyan cess the service tax would increase to 15. 60 Lakhs the rate of interest for late payment of service tax in such cases would be 12.

From 1st June 2016 onward the new rate of service tax is 15 due to the introduction of Krishi kalyan Cess 05. The 11000 salary takes up the entire personal allowance. By Paras Mehra.

12 was the basic rate 2 was Education Cess and 1 was Secondary and Higher Education Cess. Service tax above certain threshold will also be required to file an annual return. 1st June 2016 the effective rate of service tax shall be 375 BRIEF INTRODUCTION INDIAN PROPERTY SHOW LONDON APRIL 2016.

In case of assessee whose value of taxable services in the preceeding financial year is less than Rs. 132016-ST dated 1-3-2016 effective from 14th May 2016. April 2016-Sep 2016 April-May 145 July-Sep-15 Oct 2016-March 2017 Oct-March 15.

The remaining 18000 dividends are. 30 rows 435 14530 45 1530 Effective from 01042016 a uniform abatement at the rate of 70 is prescribed for services of construction of complex building civil structure or a part thereof subject to fulfillment of the. Earlier till 31st May 2015 the service tax rate was 1236.

The 15 includes 05 Krishi Kalyan Cess and 05 Swach Bharat Cess. The first 5000 of dividends is included within the dividend allowance. The effective rate of service tax will go up to 15 per cent from 1st June 2016 due to the introduction of the Krishi Kalyan Cess KKC at 05 per cent on the value of taxable service and thus wef.

Krishi Kalyan Cess which was announced during the 201617 Budget has become applicable from 1 June. While presenting the Budget 2015 the FM had increased the Service Tax Rate from 1236 to 14. A tax of 05 would be levied over and above the Service Tax and Swachh Bharat Cess.

This new rate of Service Tax 14 was applicable from 1st June 2015. The next 27000 of dividends are taxed at 75 basic rate 2025. 60 lakhs during any of the financial years covered by the notice or during the last.

In case of small service providers whose value of taxable service did not exceed Rs. Budget 2016 has proposed to impose a Cess called the Krishi Kalyan Cess 05 on all taxable services. From the 1st of June 2016 service tax is levied at 15 of the value of taxable services under Section 66 of the Service Tax Act.

Concession of 3 will be available thus making the effective rates as 15 21 and 27 pa. Till 31 May 2016 the Service Tax rate was 145. The Current rate of service tax in India is 1450 education and secondary higher education cess sub merged into basic rate.

The new effective service tax could henceforth be 15. The government will extend the VBC support for zero emission vans so that from 6 April 2016 the charge will be 20 of the main rate in 2016 to 2017 and 2017 to 2018 and will then increase on a. The Service Tax Rate applicable from 1st June 2016 is 15.

However if assessee has collected service tax but did not deposit it with Government interest rate will be 24 Notification No. For the tax payers with value of taxable service less than 60 lakh rupees in PFY interest rate for delayed payment will be 12. This Tax is required to be deposited on a MonthlyQuarterly basis.

Goods by Road service tax on grand total amount how much calculate exp- old Calculation are bills grand total 100- the calclation 1002525 x1236 service Tax amount 309- please give us 100-basic Rate X 14service Tax. 20 on annual earnings above the PAYE tax threshold and up to 32000. It can be paid either by manually depositing in the Bank or through Online Payment of Service Tax.

This rate is an inclusive rate and SHEC and Education Cess is not required to be charged above this. Basic tax rate. 409K Views April 24 2016.

The service tax rate under composition scheme for single premium annuity policies is being rationalized at the rate of 14 of the total premium charged. Full information on Krishi Kalyan Cess and its applicablility.

How To Do A Running Total In Excel Cumulative Sum Formula

What Is Gst Goods Services Tax Details Benefits

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

Gst Exemption List Exempted Goods And Services Under Gst Indiafilings

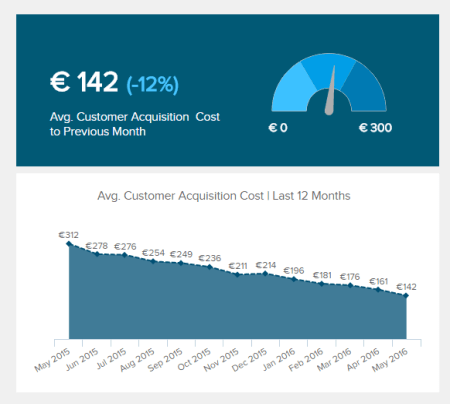

Sales Graphs And Charts 30 Examples For Boosting Revenue

Pin On Inventory Management Software India

Taxtips Ca Business 2020 Corporate Income Tax Rates

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Account_Deficit_Apr_2020-01-ca5e0d6c1ea440d68503f7730d2d5675.jpg)

Current Account Deficit Definition

Gst Rates 2020 Complete List Of Goods And Services Tax Slabs

Meaning Of Sgst Igst Cgst With Input Tax Credit Adjustment Sag Infotech

If Petrol And Diesel Are Brought Under Gst They Ll Have To Be Taxed At More Than 100 Mint

Gst Rates 2020 Complete List Of Goods And Services Tax Slabs

F Y 2016 17 Due Dates Of Service Tax Tds Tcs Central Exxcise Cst Vat Pt Esic Pf

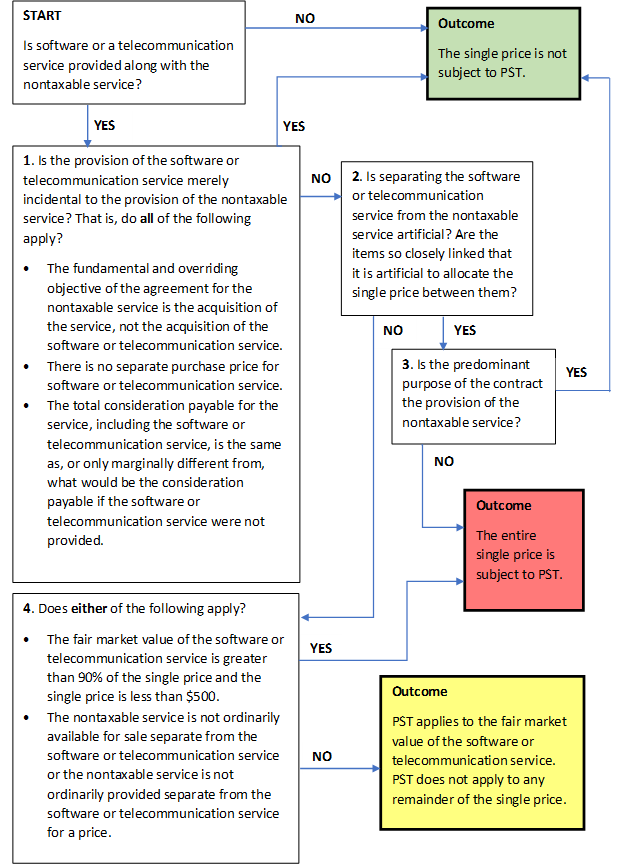

Tax Interpretation Manual Provincial Sales Tax Act General Rulings Province Of British Columbia

The Impact Of Gst On Varied Business Areas Gst Gstbill Business Tax Goods And Service Tax Business Challenge