closed end loan trigger terms

If the borrower does negotiate a modification of the loan the borrower. Any periodic rate that may be applied expressed as an annual percentage rate using that term or the.

Federal Register Regulation Z Truth In Lending

There are triggering terms associated with different loan products such as home equity credit lines closed end credit HELOCs and many other loan products.

. In a form the member may keep. Lately I have reviewed multiple closed-end loan advertisements with the same compliance issue not providing the required disclosures when a trigger term was present. Question - Our advertising division is creating a brochure to market our various closed-end mortgage products.

Missing additional disclosures on auto loans 1 Triggering terms. A trigger term is an advertised term that requires additional disclosures. For instance a few terms for closed end credit that trigger the need for additional disclosure are.

Trigger Terms Under Regulation Z. Loan Terms Page 1 of the Loan Estimate. The trigger terms for closed-end loans are.

The brochure indicates for one product that. Closed end loan trigger terms. A closed-end loan is a loan given with a specified date that the debtor must repay the entire loan and interest.

The FTC dictates what qualifies as a triggering term. Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must. Specifically the borrower cannot change the number or amount of installments the maturity date and the credit terms.

I Any minimum fixed transaction activity or similar charge that is a finance charge under 10264 that could be imposed. Since the APR is stated does it trigger any further disclosures. Sometimes mortgage advertisers are not fully aware of the regulation z triggering terms rules that require additional disclosures to be made in your.

A trigger term is used when advertising what type of credit plan. 36 to 72 month auto loans. Closed-End Auto Loan Ads.

If any of the. Ii Any periodic rate that may be applied expressed as an. However the APR is a triggering term for open-end credit.

A triggering term is a word or phrase that if used in credit advertising requires additional credit agreement disclosures. I The amount or percentage of any downpayment. 4 the amount of any finance charge.

4 No down payment 10 APR Rate loans are available Easy monthly payments Loans available at 10 below our standard APR. If any of the following terms is set forth in an advertisement the advertisement shall meet the requirements. D Advertisement of terms that require additional disclosures 1 Triggering terms.

If an advertisement promoting closed-end credit for real estate contains any of the following trigger terms the three specific disclosures listed at the bottom of this page must also be. Triggered Terms 102616 b. The APR is not a trigger if its a closed-end loan.

Determine whether a separate table under the heading Loan Terms contains the following required disclosures 102637 b. Requiring creditors to comply with uniform standards for stating the cost of credit so that consumers can compare loan products Trigger terms for closed-end loans include all of the. However disclosures arent required when lenders use phrases that arent defined as triggering terms for closed-end credit products such as.

Closed end credit trigger terms. Closed-end loan is a legal term applying to loans that cannot be modified by the borrower. Credit sales only ii The number of.

If any of the following terms is set forth in an advertisement the advertisement shall meet the requirements of paragraph d 2 of this section. These loans are normally disbursed all at once in order for the debtor to buy or. The disclosures will be in a reasonably understandable form and legible.

Triggering terms for closed-end loans The number of payments or period of repayment such as 48-month payment term or 30-year mortgage this is often the most.

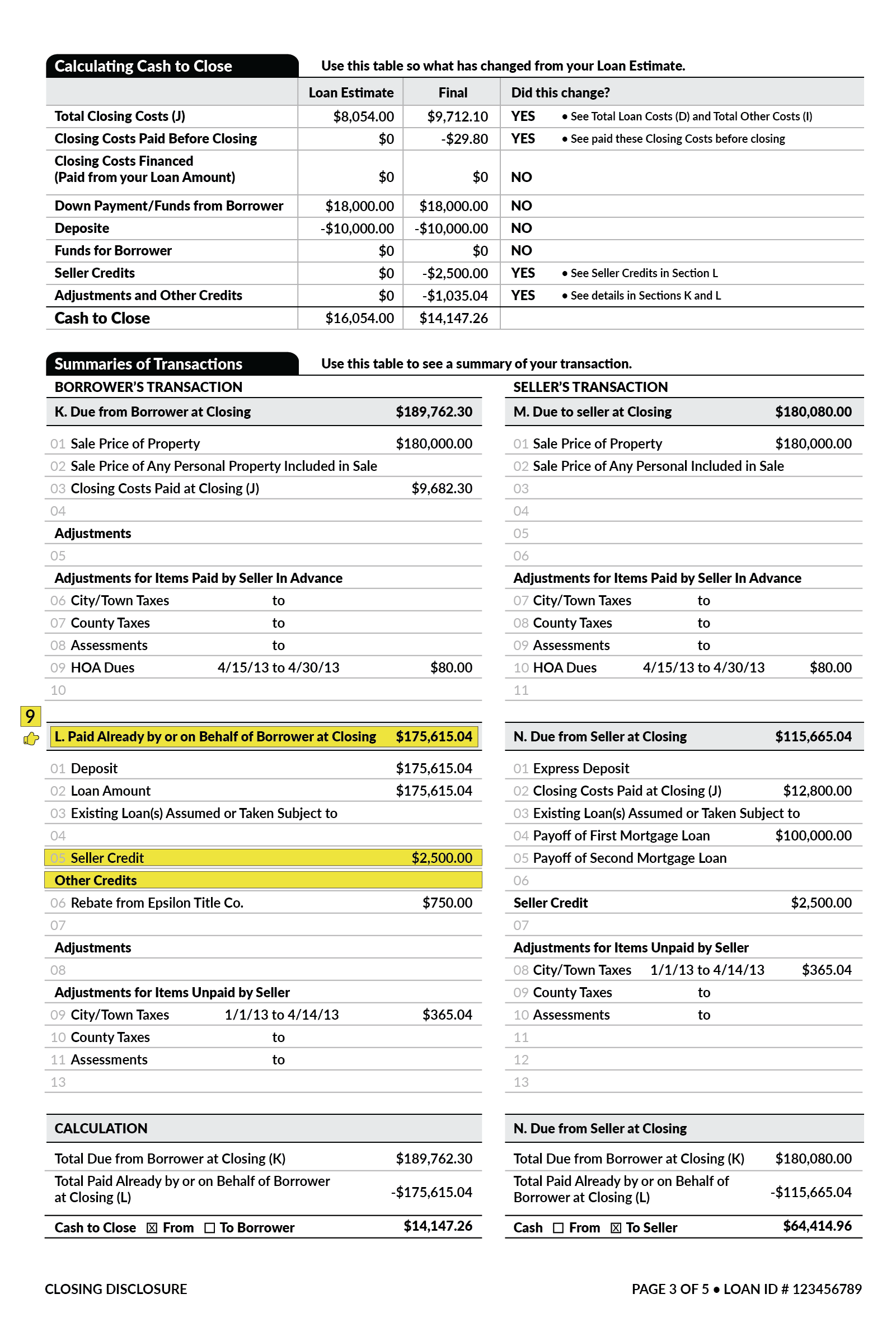

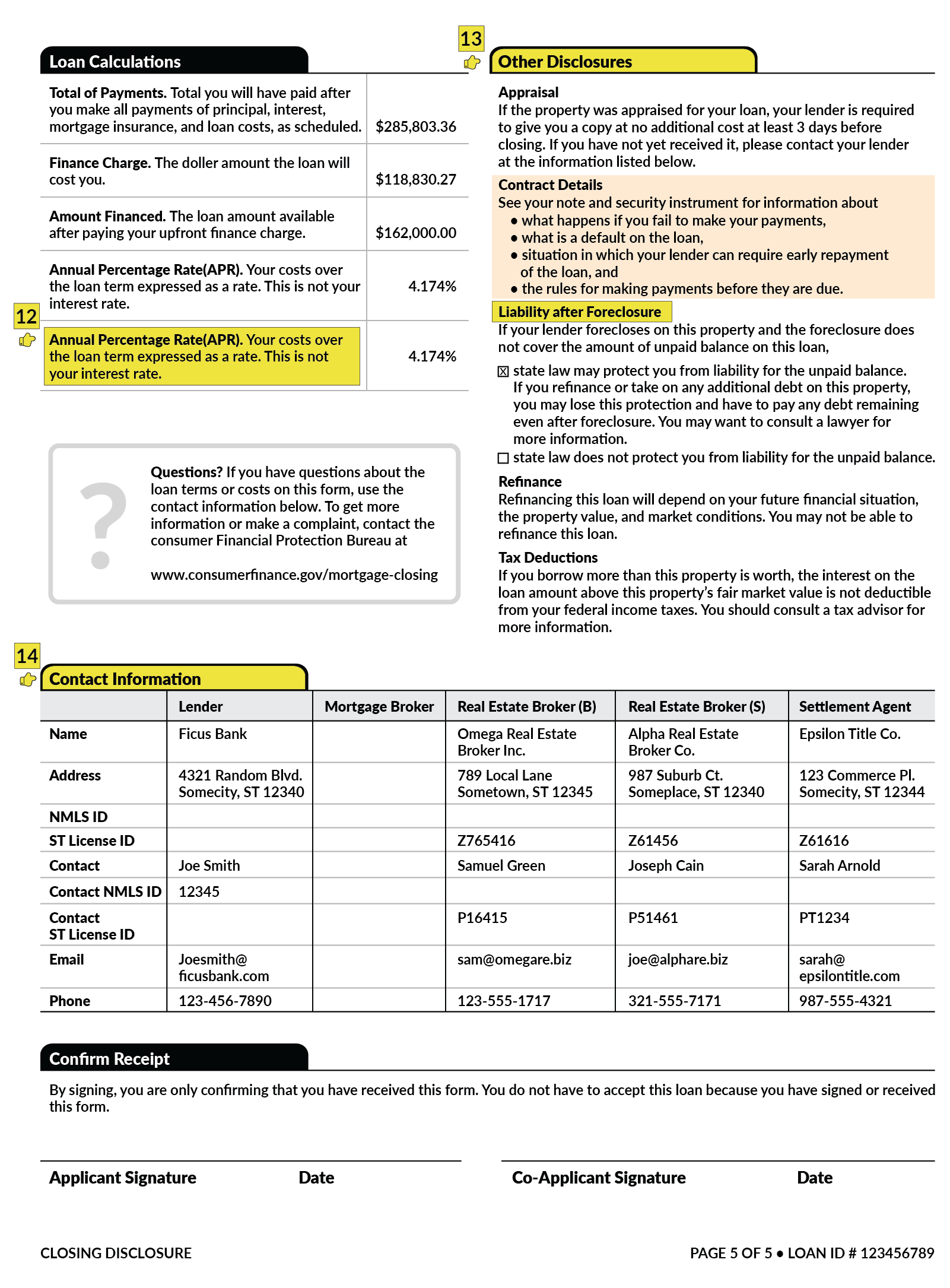

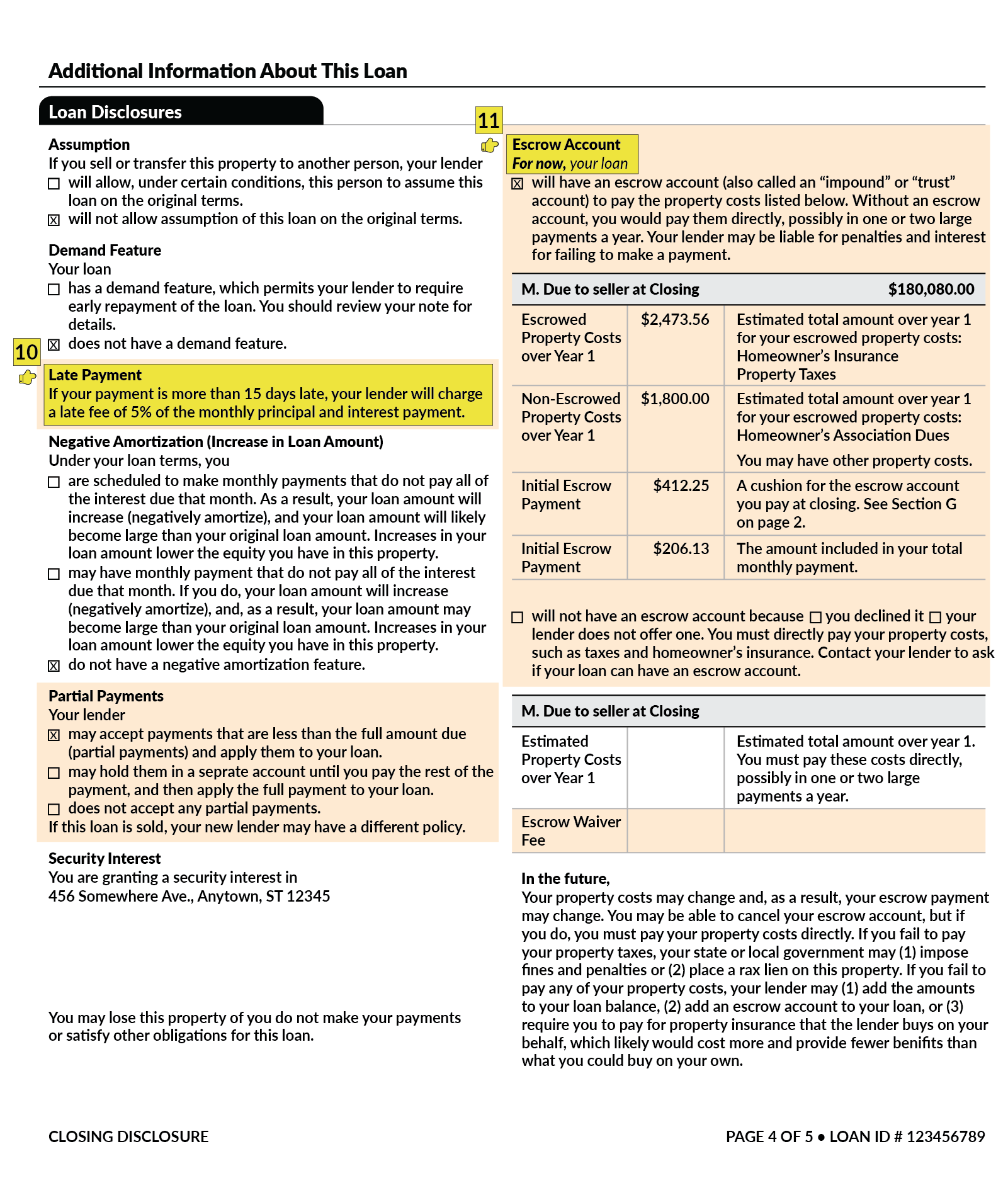

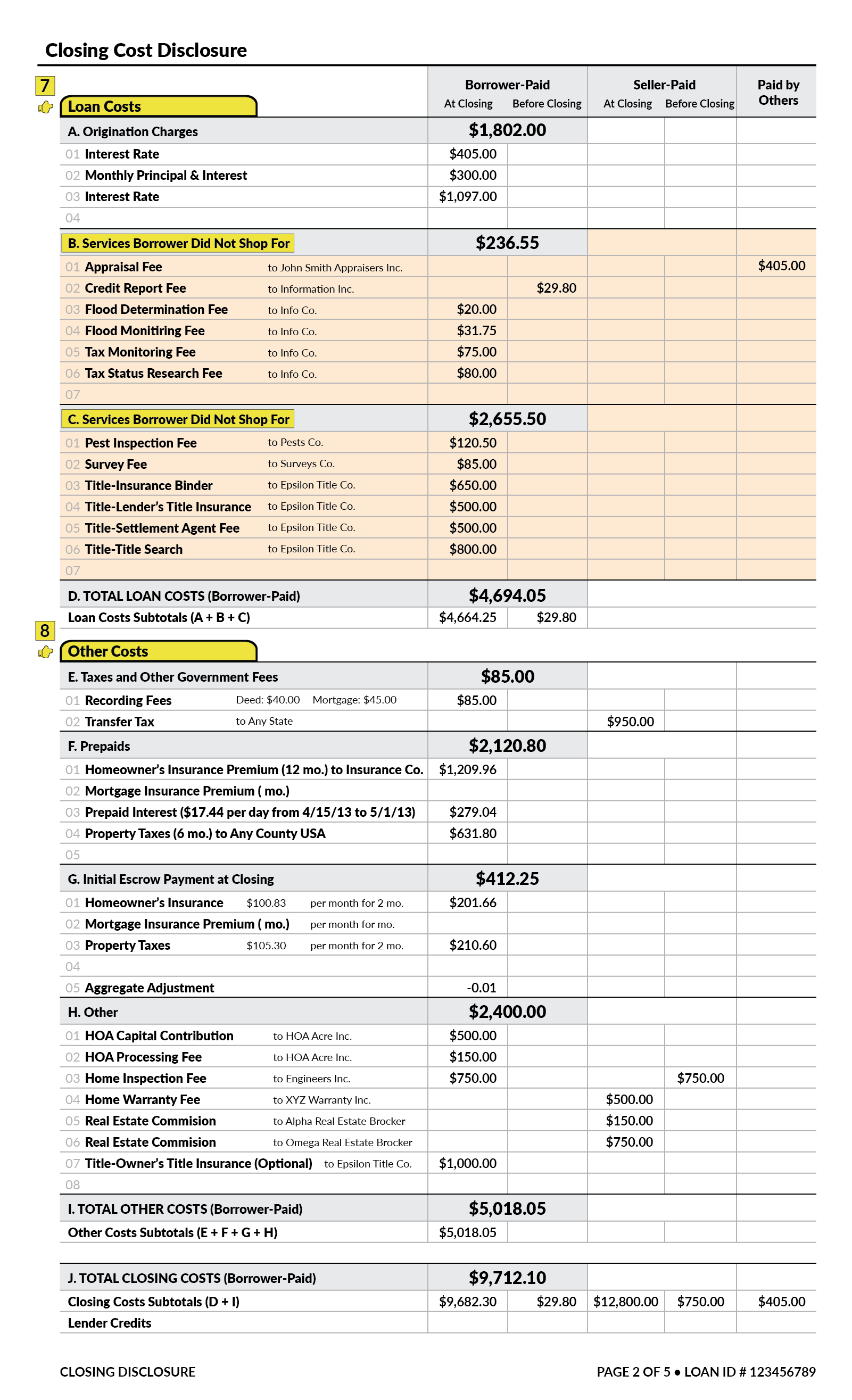

What Is A Closing Disclosure Lendingtree

What Is A Closing Disclosure Lendingtree

Federal Register Truth In Lending Regulation Z

Federal Register Regulation Z Truth In Lending

Federal Register Regulation Z Truth In Lending

What Is A Closing Disclosure Lendingtree

Federal Register Regulation Z Truth In Lending

:max_bytes(150000):strip_icc()/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

What Is A Closing Disclosure Lendingtree

Federal Register Truth In Lending Regulation Z

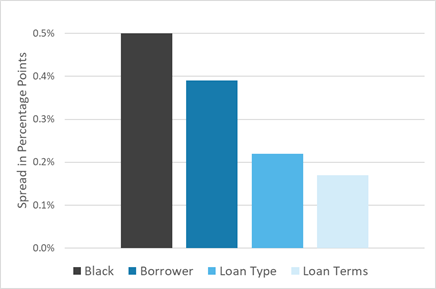

Fair Lending How To Detect Loan Pricing Discrimination

Understanding Finance Charges For Closed End Credit

/GettyImages-520885672-a69470168f764663a37e873e291c8b37.jpg)

:max_bytes(150000):strip_icc()/401_k_istock479882934-5bfc328f46e0fb0051bf266e.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-597314925-72053ed3e7d54bcca2b40d3d84937d67.jpg)